Most people don’t realise you can get ultra high value gifts with their credit card application.

Not you, because you’re here.

I will walk you through how to maximise your credit card rewards with right strategy from the start laying out the key ideas so that you can do this for yourself in the future.

I promise that if you do exactly what I lay out, you will walk away with gifts or cash value of at least $500.

Disclosure: This post may contain affiliate links, meaning if you decide to make an application via my links, I may earn a commission at no additional cost to you.

Credit card sign up bonuses change all the time. I will walk you through the cards with the best high value gifts in this tutorial.

How do sign-up rewards work?

Credit cards earn money from three things – interest (it compounds too!), transaction fees charged to merchants and consumers.

Why am I telling you this?

To convince you that they can afford to give out high value gifts because credit card companies do have high revenue. In the past, they used to engage telemarketers. Now companies like Singsaver act as the advertising vendor if you wish. At the end of the day, the smart consumer knows how to benefit. A point to note that in order to receive the high-value gift, you should use my affiliate links to the Singsaver application page or from the Singsaver website directly. That said, the rewards that banks provide directly may not be stackable. Do your due diligence to see what works best for you.

Whatever you do, be smart about it (I am going to teach you how). Make sure you avoid any fees you don’t have to pay.

Now that we got that settled. Let’s move on.

How long does it take for credit card to be approved?

Approval of card takes usually a few business days. Between my husband and I, we have applied for 4 credit cards and received 3 high value gifts (2 iPads and 1 Dyson vacuum cleaner). All the cards were approved on the same business day.

It is important to note that we are in excellent credit standing. We do not have any outstanding credit debt at all and have not maxed out at all on our loan ratios. These can affect your credit card approval times.

How long does it take to collect iPad?

Based on our experience, we collected our iPads about 1 month after fulfilling $500 spend and paying the first credit card bill.

It took longer with the Dyson, 3 months after fulfilling the criteria.

We are still waiting on the apple watch, it is 3 months since I fulfilled the criteria. I emailed Singsaver lately and they assured me that I will be receiving the redemption email by end December.

Can I cancel the card after I receive the gift?

Yes and no.

Some cards come with the clause that you have to hold on to the card for at least year or they reserve the right to claw back the cost of your gift. It was the case back then with our Citibank Rewards card. Hence, I advocate only taking on these cards IF you want to hold on to them. Citibank Rewards card earns 4mpd so we have held on to them.

The Standard Chartered card does not have such a clause. I like it because it provides cashback on medical bills. I do not have a cashback card and it is nice to get rebates for medical bills.

Step-by-step guide to get a free iPad with a credit card

This guide is meant to help you choose your own credit card based on your spending habits, budget and lifestyle. I firmly believe that there is no one size fits all recommendation. I am always an email away or contactable on instagram if you would like to chat about your approach.

Understand Your Spending Habits Before You Apply

Credit cards are designed to target a demographic with a certain spending habit.

Knowing your spending habits will align your expenses with the card requirements. So you get BOTH the best sign-up rewards AND the best long term rewards (cashback or miles).

For the purpose of sign-up rewards, you will need to spend a certain amount (usually $500) within a certain period of time – usually 30 days from card approval. So I like to make sure I time the application with purchasing needs.

Analyse your past spending patterns and identify your top spending categories. Knowing your consistent spending will allow you to choose a card that fits with your long term spending patterns. You can begin to categorise your spending into groups and strategise like this.

Two things to consider

- How much do you spend monthly on groceries, dining, online shopping (e.g. Lazada / Amazon / Shopee), petrol, subscription fees (Netflix etc) or public transport?

- When will you spend or plan to spend on large purchases – food for a party/festive season, travel, electronics, home furniture & appliances?

These large once off seasonal purchases usually add up. If I take my family for a restaurant meal, it is likely to cost me $300. That can be put towards applying for a credit card and getting a high value gift such as an iPad! Think about Christmas, Chinese New Year, birthday parties! You could be celebrating for free!

Here’s what I put on my application for Standard Chartered Simply Cash Credit Card this month to qualify for an Apple Watch SE (GEN 2) GPS + Cellular 44mm (worth S$503.60)

Choose the Right Type of Rewards Card for Your Goals

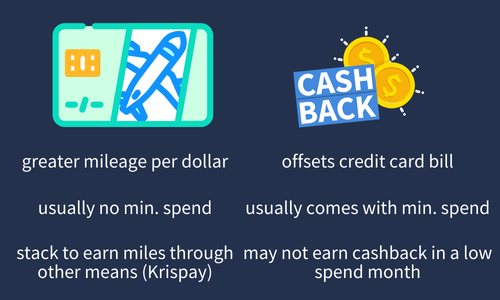

Miles Rewards vs Cashback?

This really boils down to your preference and financial goals at this point in time. It can change later on like it did for me.

When I first started out, I preferred cashback because I wanted extra cash to offset my credit card bill.

The Case for Miles

Now I find that earning miles on credit card gives me more mileage (pun intended!) for each dollar. I am pretty close to redeeming return flights for 4 to KL on Singapore Airlines. If you follow me, you know I am very prudent, I won’t pay extra to buy miles at this point in time. So.. earning 4 return flights on my very basic spend in a year is a feat!

Let me share some mum mile math to make this more real for you.

Example 1

Online shopping = $600 (Put on Citibank Rewards Card to earn 4mpd)

A return flight to KL on Singapore Air costs 17000 miles to redeem.

If $1 = 4 miles. How many dollars will you need to spend to get 17000 miles?

I bet you didn’t think problem sums will come in handy.

Anyway, the answer is at least $4250 or about 7 months.

I said at least because Citibank rewards 4 mpd for each $1. Expenses less than $1 will not earn any miles. So a $2 transaction earns you 8 miles while $1.99 transaction earns you 4 miles.

Example 2

Dining + groceries = $600 (put on UOB Ladies’ Card to earn 4 miles per dollar (mpd) if dining and family are the selected reward categories.

That said, it’s a good time to mention that I don’t split hairs with the miles. I put the right spending on the right card and enjoy the reward. I optimise the expenditure and accept that not every single dollar or cent is going to earn the mile.

The Case for Cashback

The Wealthy Dad is still on team cashback but that is mainly because he wants the maximum discount for petrol which he pays for.

What I don’t like about cashback cards is that they usually have a minimum spend to qualify for higher cashback (some with category limitation). I find that as a frugal person I feel anxiety having to spend a minimum of $800 to qualify for something. Low spending months will totally disqualify us. As a consumer, I prefer not to be in this position.

At the end of the day….

There is no right or wrong here. Clarify what your goals are and use that to guide your decision. I am always a DM or email away as a sounding board.

Compare Sign-Up Bonuses and Introductory Offers

Once you have decided on your choice of card, it’s time to compare sign-up rewards especially for new-to-bank customers.

These are the LATEST offers on Singsaver that I feel are worth applying. I monitor their offerings monthly and when I feel that there is a suitable opportunity for me in line with my high spending period, I will apply and enjoy the rewards. If there isn’t a high value gift at the moment for your target card, I would recommend waiting it out for a few months or changing strategy.

Read my exception

The ONLY exception is… if the card you are applying for increases the interest on your current account. In Singapore there are 3 common ones - DBS Multiplier, UOB One Account, OCBC 360 Account. Then I would say go ahead if you have a good sum of money inside ready to earn interest.

I left out these cards that didn’t have good sign up offers from this list. We definitely have a case to apply for them and those articles are coming right up. Make sure you are signed up for the mailing list to get notified.

Note: Many of the following are for new-to-bank customers. Time your application and spread your cards out over the years.

Credit Card Recommendations (check the latest rewards here)

| Sign Up Links | Citi Rewards Card | HSBC TravelOne Credit Card  | Standard Chartered Simply Cash | Standard Chartered Journey Credit Card |

| Annual fee waived for first year | First year waived | Must pay $196.20 annual fee | First year waived | First year waived |

| Qualifying income | $30, 000 | $30, 000 | $30, 000 | $30, 000 |

| Sign up rewards | Dyson Micro 1.5kg Vacuum(worth S$599) OR Apple iPad 10th Gen 10.9 wifi 64GB (worth S$529)NEW OR Dyson Supersonic™ (worthS$649) OR S$450 Shopee VouchersNEW | Flujo SmarTrax Standing Desk (worth S$739) OR Sony WF-1000XM5 (worth S$429) OR Xiaomi Robot Vacuum S10+ (worth S$569) OR S$330 Lazada Voucher | Dyson Micro 1.5kg Vacuum (worth S$599) OR Apple IPad 10th Gen 10.9 wifi 64GB (worth S$529) OR Sony WH-1000XM5 (worth $589) OR S$380 Cash via PayNow | Beats Studio Buds+ (worth $231.10) OR S$270 Shopee Voucher |

| Criteria | Spend $500 within 30 days of card approval | Spend $500 within 30 days of card approval Existing holders of HSBC credit cards eligible! | Spend $500 within 30 days of card approval | Spend $500 within 30 days of card approval |

| Current promo period | 6 – 30 Sept | 6 – 30 Sept | 18 – 30 Sept | 6 – 30 Sept |

| Miles / Cashback | 4 mpd on online transactions | 1.2 mpd on local transactions 2.4 mpd on FCY | 1.5% cashback No minimum spend and no cap | Earn 3 mpd for transportation, food delivery and online groceries Earn 2mpd with no cap for FCY |

| Good to note | Pair with amaze card to turn offline transactions into online transactions | If this is your only HSBC card, be careful about spreading your mile too thinly across banks. Takes longer to accumulate enough to transfer to an airline partner. | If this is going to be your online SCB card, I would recommend going for the cashback so that you don’t get orphaned miles which aren’t enough to transfer out. | Sign up bonuses not that great but is a decent miles card for overseas spend imho if you’re gonna go shopping at luxury stores at the end of the year The other competitor is DBS Altitude which does not offer a good sign up bonus atm. |

Read the Fine Print

I cannot emphasise this enough. As much as I am giving you all the information I can, it is your duty to do your due diligence. At the end of the day, it’s your money and your time.

What I recommend is to read the fine print of the Terms and Conditions document for each card you are applying for.

I do this diligently for every card with a highlighter and a pencil to take notes.

Most of the time, I notice the information is in clause 5. Here in the information you need to look out for:

This is where you do your due diligence. I see it as being paid for reading la. Most of the information will be in Clause 5.

- Deadline for application

- Deadline for card approval

- Minimum spend

- Deadline for minimum spend

- Excluded categories (payment for school fees, transfers, insurance etc)

- When you will receive the notification of reward

Timing Your Application for Maximum Rewards

You have to time the application to match it with your predicted expenses so that you spend exactly what you need to fulfil the requirements. Make sure you have enough runway on the promo period to get approval and to spend. For example, I had been eyeing the Standard Chartered Simply Cash Credit Card for a month. But the promo period coincided with National Day holidays and I wasn’t sure if I would get the card approval in time so I waited and I checked their website daily! Now I am doing this for you. I always apply at the start of the promo period and prefer the promo period to be at least 3 weeks long.

If you for some reason didn’t fulfil the criteria, let it go. Pay the credit card fees. Use it if you want to. If not, cancel the next month. There is technically no loss to you, treat it as an experience.

Follow Up After Application Submission

Submit rewards redemption form that SingSaver sent to you in your email. MUST DO.

Don’t do = no reward even if you fulfilled everything else

Then, monitor for credit card approval. You will need to do the necessary banking steps like the app set ups and stuff. I try to set up the e-card on Apple or Google Pay as soon as possible so that I can start spending.

Then, I like to put a piece of tape and write the deadline to complete spending requirements.

Proceed with spending! If at this point you are over budget (for whatever reason), just let the gift go. Don’t go into debt for this. NEVER go into debt for this!

In a month or so, monitor your email for reward notification and collect it as per instructions!

Summary

- Credit card companies offer high-value gifts to attract customers which you can use to your advantage

- Understand your spending patterns (regular or seasonal large expenses) and utilise them to get high-value gifts, cash or vouchers.

- Choose cards that align with your finance goals for longevity of use. Otherwise, be ready to axe them if you don’t need them.

- Don’t spread your miles too thinly if you are frugal like me.

- Be an educated consumer and always read the fine print.

- Never go into debt on a credit card as the interest compounds at a whopping 25% or higher these days.

- Always pay your bills on time as late fees ($100 or more each month) will wreck your finances.

The cards I applied for were:

Citi Rewards Card (chose an iPad)

Standard Chartered Simply Cash (aiming for an Apple Watch)

I wish you all the best in your credit card application so that you can make the best out of every dollar!