An emergency fund is a financial safety net to help us navigate unexpected events in life. It is a big sum of money so we should use liquid financial tools that are easy to access while keeping our money safe and growing.

An emergency fund is a financial cash resource that we earn interest from. In this article, I will share various options and my easy personal strategy for maximising the interest earned from my emergency fund. You can also download my checklist to help yourself set up the accounts to make full use of every dollar you put aside.

If you’re growing your emergency fund, be sure to read my comprehensive guide and check my Emergency Fund Challenge which provides you valuable free resources to get your emergency fund set up.

Should I have a separate account for my emergency fund?

Yes you should. Have a dedicated account to separate your emergency fund from daily spending. This encourages discipline and as it is you will not have direct access to it when spending money.

If it comes with a bank or debit card, I recommend leaving it in a safe at home so that you have easy, but not instant, access to it. This is a preventive measure especially for those who are prone to impulse splurges.

Which accounts are the best to store emergency fund money?

The best option to store your emergency fund money is a high-yield savings account – HYSA for short. HYSAs offer higher interest rates compared to standard savings accounts so your money will continue to grow while remaining accessible.

As it is a bank account, your capital (the amount of money you deposit) will not depreciate in value regardless of market conditions. $10 000 will remain $10 000.

Banks in Singapore are regulated by the Monetary Authority of Singapore (MAS) which ensures that our money is safeguarded. The Singapore Deposit Insurance Corporation Limited (SDIC) covers up to $100 000 per depositor (customer) per bank.

Which savings accounts give the best interest in Singapore?

There are many accounts that give high interest to store your emergency fund. I will recommend 2 bank accounts to store your emergency fund. I personally use them and find their conditions easy to fulfill.

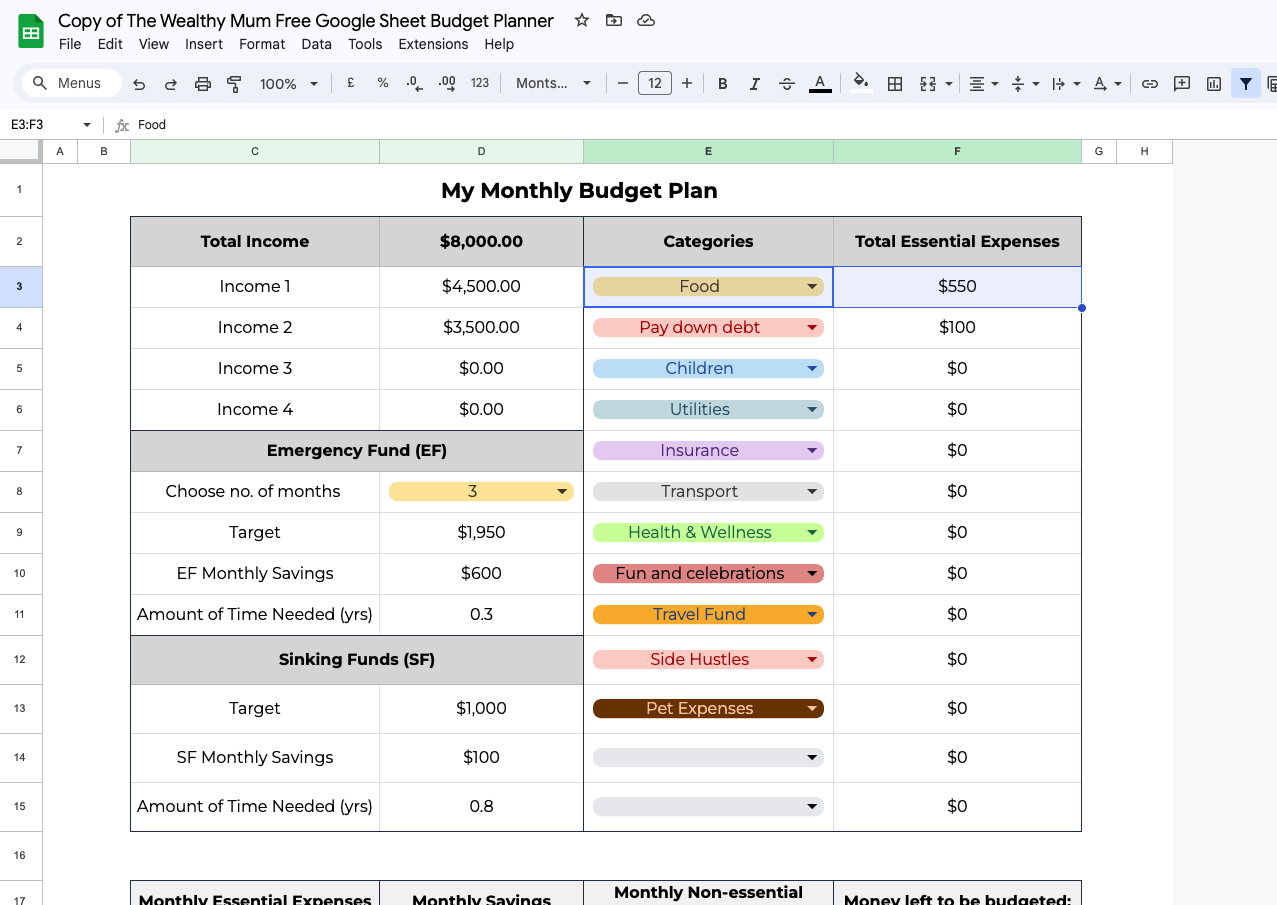

OCBC 360 Account

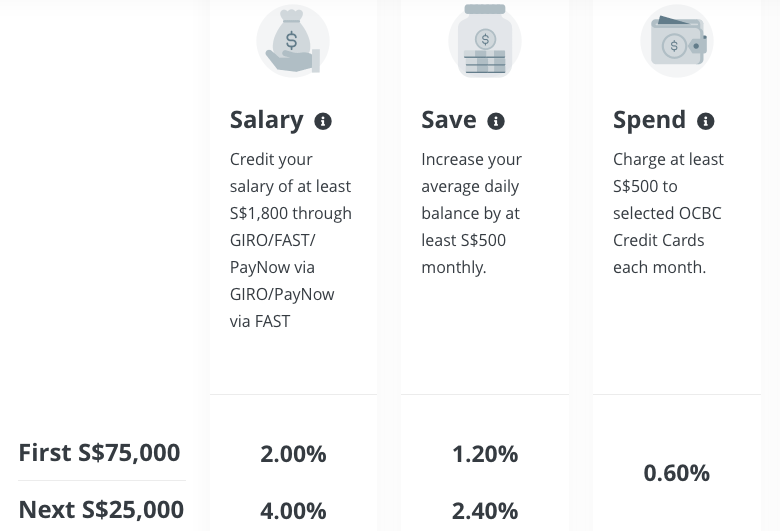

This is one of the best interest rates in town. You can earn up to 4.65% on your first $100 000 when you credit your salary, save and spend.

Criteria for up to 4.65% on first $100 000

- Credit your salary of at least $1800

- Charge at least $500 to selected OCBC credit cards each month

- Increase your average daily balance by at least $500 monthly

Average daily balance is calculated by taking the sum of money you have in the bank each day and dividing by the total number of days (e.g. 30 or 31 days in a month).

Use this account to store your emergency fund. This ensures that the amount of money in the account remains consistent other than your emergency fund contribution and your salary crediting.

I have created a comprehensive account set up guide to help you set up your finances and ensure you meet all the necessary criteria effortlessly. The sign up box is down below or you can get access right away here.

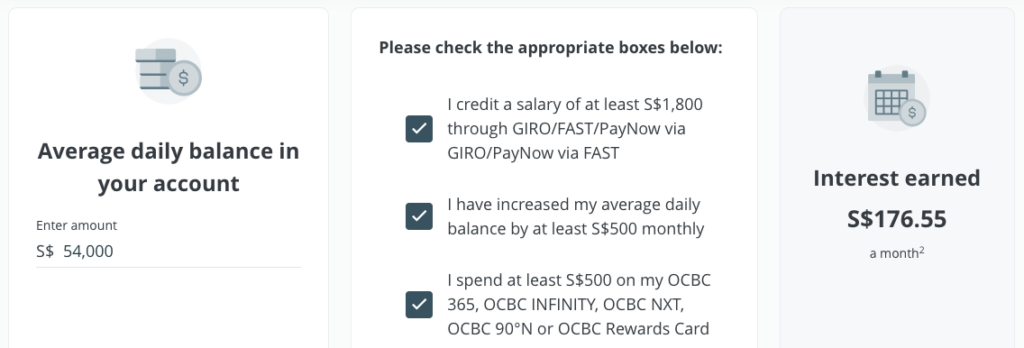

Storing an emergency fund of $54000 in OCBC 360 account and fulfilling the criteria above earns you interest of $176.55 a month.

OCBC credit cards that qualify for the Spend bonus interest for OCBC 360 account is OCBC 365, OCBC Infinity, OCBC NXT, OCBC 90N or OCBC Rewards Card.

The card I use for this account is the OCBC Rewards Cards. They reward 6 – 4 miles per dollar (mpd) for department stores, clothing stores, Shopee, Unity and Lazada.

UOB One Account

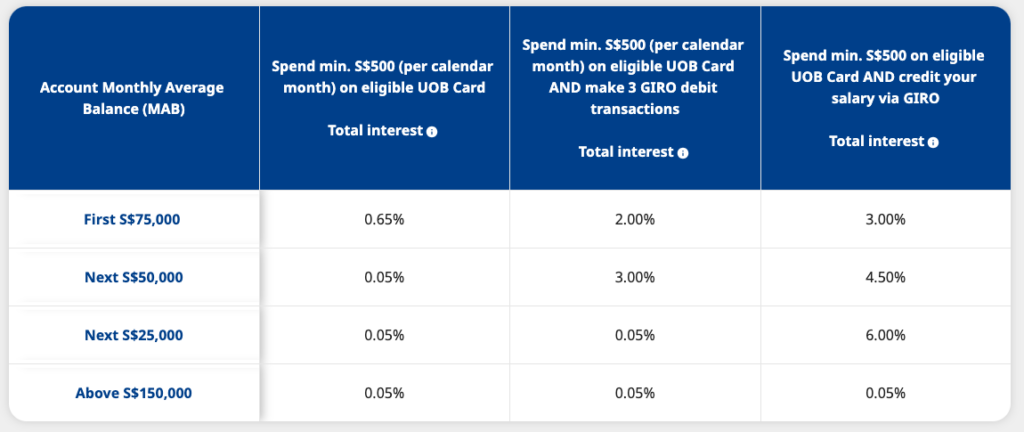

You can earn up to 4.00% for deposits of $150 000 when you credit your salary and spend.

Many of us will credit our salary into one only account. UOB One offers a great is 2.4% for deposits up to $120 000 with $500 spend on an eligible credit card and 3 GIRO debit transactions.

Criteria to earn 2.4% for amounts up to $120 000

- $500 spend on eligible credit/debit card

- 3 GIRO debit transactions

On this note, I would like to mention that UOB offers up to 4.00% for deposits with salary crediting and higher balance.

UOB credit cards that qualify for the Spend bonus interest for UOB One account are UOB One Card, UOB Lady’s Card (all card types), UOB EVOL. The account even comes with a debit card – UOB One Debit Visa Card that you can use to qualify for the spend criteria.

Unlike the OCBC 360, UOB one does not require you to increase your average daily balance by $500. This makes it the perfect account to spend out of.

The credit card I use with this account is the UOB Lady’s Solitaire credit card. My bonus categories are Family and Dining because those make up my regular expenditure. This card rewards up to 10 miles per dollar on your chosen categories.

My personal strategy when I am growing my emergency fund

As I am a working parent growing my emergency fund, my personal strategy is to use the OCBC 360 account to store my emergency fund. All expenses and payments for bills come out of UOB One account. You can get my comprehensive emergency fund account set up guide from my resource page here.

Other Accounts to Store your Emergency Fund (non-salary crediting)

GXS

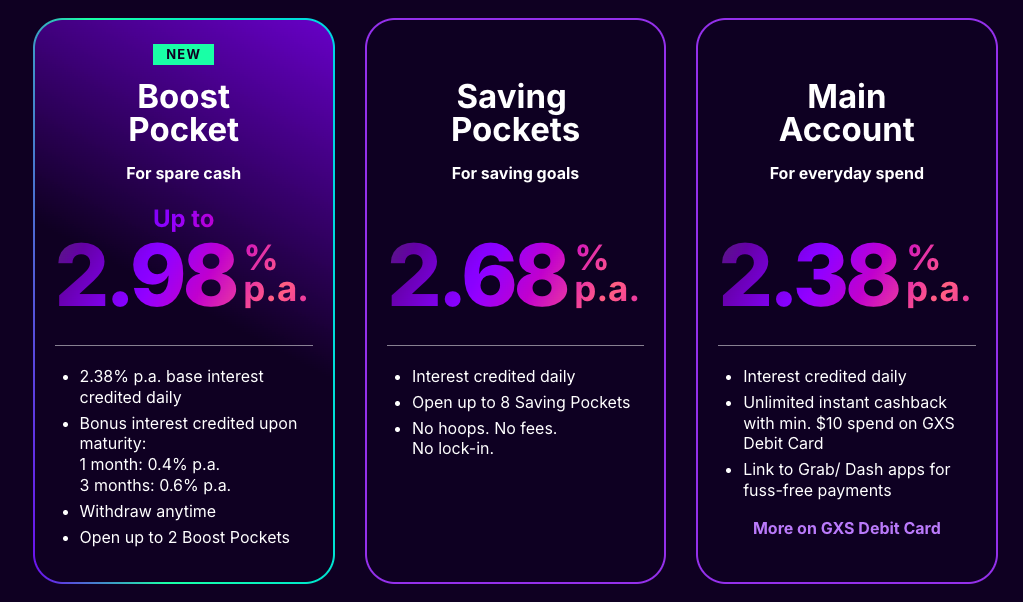

GXS is a digital bank set up by Grab which is licensed by the Monetary Authority of Singapore and is part of the SDIC. This means that your savings are insured up to $100 000 for their savings accounts.

Their Boost Pocket for storage of spare cash can earn you up to 2.98% per annum. With no hoops to jump through and interest credited daily, this is also a viable and useful account to store your emergency fund.

Personally, I would use this if I am not able to meet the criteria to earn higher interest rate of the OCBC 360 account or UOB One Account if I were a student, retired, SAHM without a salaried income.

Singapore Savings Bonds and T-bills

Singapore savings bonds are safe and flexible bonds. A savings bond is a type of investment that pays a fixed interest rate over a set period of time.

The minimum investment is $500. You can check MAS website for latest interest rates and deadline. It is easy to apply via Internet Banking or AMTs.

You can redeem Singapore Savings Bonds in any given month before it matures. There is no penalty for exiting your investment earlier than the due date of the bond. You would have to redeem the bond within the 1st and 4th business day of the month.

This makes it a very safe and viable alternative to bank accounts to store your emergency fund for longer term as you have access (not immediate) to it without incurring any penalty.

T-bills on the other hand are shorter term government debt securities. They are essentially issued by the government to raise funds. They are considered low-risk investments because they are backed by the government and provides us with a secure option to store our emergency fund.

As they have shorter term maturity – 6 months to a year, I would use it if I have exhausted all my other options. This is an attractive some temporary mode of investment when the interest rates are high.

Should I invest my emergency fund?

I would not recommend investing your emergency fund as it provides the first layer of financial security for you and your family.

I would only consider investing my own emergency fund if I hold beyond 6 months of essential expenses in cash. Reasons one might do so are being adverse to higher risk investment modes or nearing retirement where you want to reduce your risk exposure.

Lower-risk investment strategies to store emergency fund

Money Market Funds

Money market funds are lower-risk (not no risk) investment options. They work by pooling money from investors like you and me to invest in short-term, high-quality debt instruments like government securities, fixed deposits and corporate bonds. Some of these may not be easily available to retail investors like you and me.

Money market funds are meant to provide customers with stability, liquidity while providing decent returns.

Money market funds are not without risk. Though they aim to preserve capital while providing slightly higher returns than traditional savings accounts, it is key to note that they are not capital guaranteed. This means that there is a chance that you can lose money that you put in.

You can buy money market funds on brokerages or trading platforms such as Moomoo, Webull, Tiger brokers for FSMOne. This would general keep fees the lowest as you’re doing it yourself.

Roboinvestors such as Endowus, Stashaway provide automated cash management portfolios of various risk levels. You can explore these if you want an alternative to traditional accounts.

My personal experience and strategies

As a mum to two young children, I prefer to store my emergency fund in traditional savings accounts. When it comes to my emergency fund, I am risk averse and I want to sleep with a peace of mind knowing that whatever I have put aside will be readily available to me.

As the emergency fund is the foundation of my finances, I want to spend minimal effort and time on it.

In the growth stage, my strategy is to use the OCBC 360 account to store my emergency fund and spend out of UOB One Account. Once I hit my goal and am not no longer adding to it monthly, I probably would swap it around to avoid having to fulfil the “save” criteria.

Do check out my comprehensive Emergency Fund Account Set Up Guide. You can sign up down below.

Affiliate Disclaimer

This article may contain affiliate links, which means I may earn a small commission at no additional cost to you if you make a purchase or sign up through these links. I only recommend products and services I genuinely believe in and that align with my goal of helping you make every dollar count. Your support helps me continue creating valuable content—thank you!