Return flights to Japan for a family of four? That’s easily $4000 – $5000 on Singapore Airlines during holiday period. For most mums, at least for us, that’s money that definitely can be spent elsewhere – investing, saving or groceries, you name it. What if you could earn these miles without spending any extra money?

So when I discovered I could earn Krisflyer miles with money were already spending to turn those dream holidays into reality, I was excited about how far I could take this (no pun intended!)

Over three years, we earned 260 000 miles using our regular household budget – groceries, petrol, shopping, clothes, household appliances etc. The result? Free return flights to Japan for four.

Sounds too good to be true? I thought so too. But its surprisingly easy and straightforward to earn miles for flights once you get to know the system.

Here’s exactly how I did it.

The Strategy – How to Earn Miles Without Extra Spending

Here’s the beautiful truth about earning free flights: you don’t need to spend more money to do it.

Miles rewards cards in Singapore offer credit card points when you use them for everyday purchases. The key is to use these cards for expenses you’re already making – groceries, dining out, shopping, petrol – and pay them off in full each month. These credit card points can then be exchanged for airline miles.

Bear in mind that this isn’t about spending extra. It’s about simply putting spending on a card that gives you the most rewards.

3 Most Important Things About Earning Credit Card Miles

- Replace cash with credit cards: Use your rewards credit cards instead of cash or debit for purchases you’d make anyway. Your spending stays the same, but now you’re earning points.

- Pay in full, always: This is non-negotiable. Credit card interest will quickly erase any rewards benefit. Only use this strategy if you can pay your full balance every month.

- Stack the bonuses: Take advantage of sign-up bonuses (often worth 10,000-30,000 miles), category bonuses (like extra points on groceries or online shopping) and shopping apps like Krist+ and HeyMax.

Let me show you how this works out

Between 2022 and 2025, we spent approximately $1500 – $2000 per month. This usually includes our groceries, dining out, petrol and shopping. On occassion, we have larger purchases such as home furniture, electrical appliances and some travel expenses. By putting these purchases on the right credit cards (and paying off all purchases in full each month), we earned over 260,000 miles in 3 years.

That’s enough for return flights to Japan for our family of four, plus some leftover miles for future trips.

The best part? We didn’t change our spending habits or buy anything we didn’t need. We simply channeled our existing expenses through cards that rewarded us for it.

This works especially well for mums managing household budgets because we’re already making significant monthly purchases. Take our average monthly food cost as an example – $150 a week is $7,800 a year. That’s serious earning potential just from buying milk and vegetables. Other things like diapers and gifts are substantial expenses that can generate serious miles when put on the right cards.

In the next section, I’ll break down the exact 3-step system I use to maximize these rewards without any financial risk or extra spending.

3-Steps to Earn Miles Without Extra Spending

Now that you understand the strategy, let’s break down the exact system I use to earn maximum miles while keeping my finances completely under control.

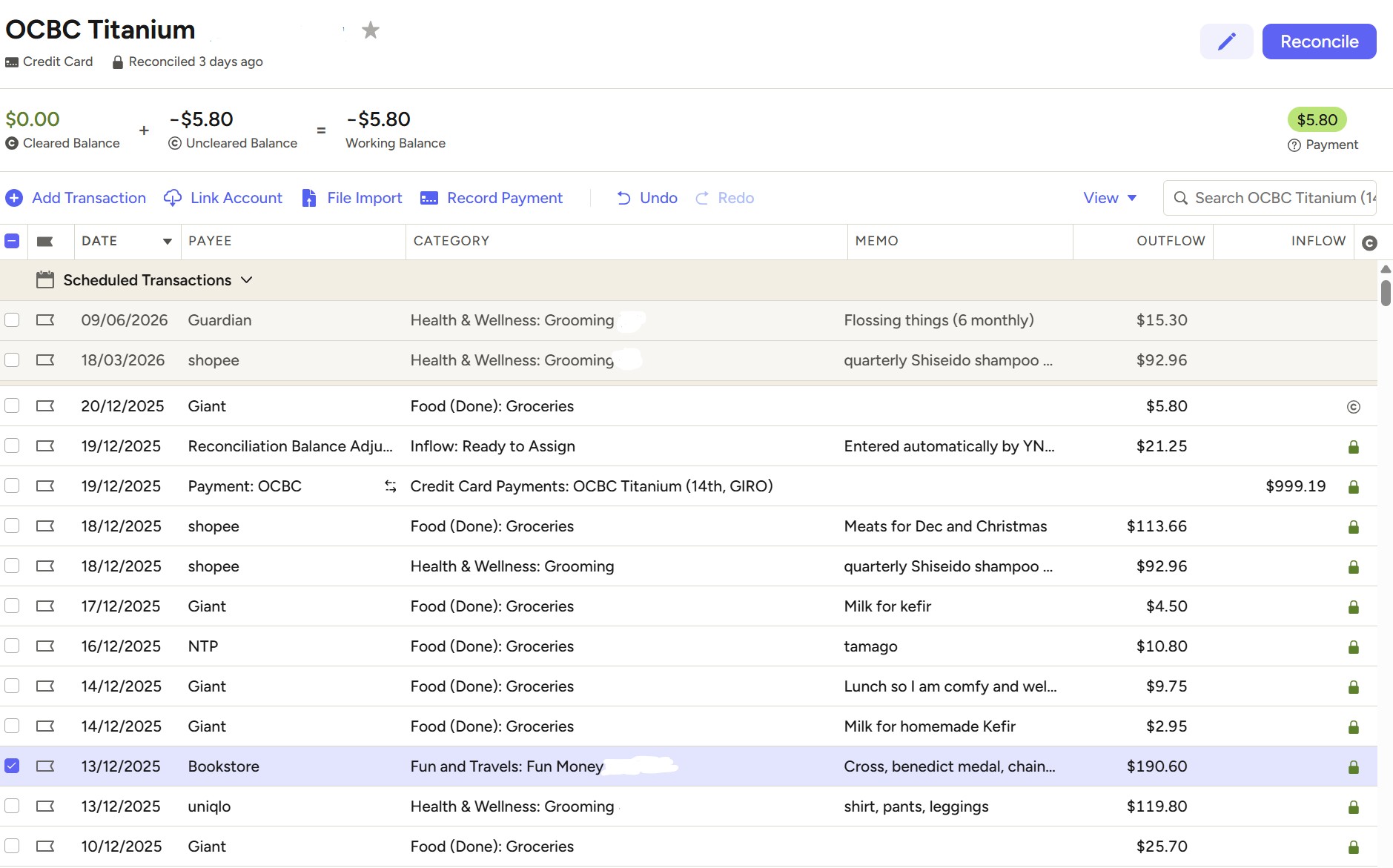

Step 1: Track Your Current Spending

Before choosing any credit card, you need to understand where your money actually goes each month. This isn’t about creating a strict budget – it’s about identifying your spending patterns so you can match them with the right rewards cards.

Here’s what to do:

- Review 2-3 months of bank statements: Look at your regular expenses and group them into categories like groceries, dining, online shopping, petrol, bills, and general spending. You can use a simple excel sheet to analyse your spending patterns.

- Identify your top spending categories: Where does most of your money go? For many mums, it’s groceries and online shopping. For others, it might be dining out or petrol.

- Calculate monthly totals: Estimate how much you spend in each category per month. This will help you calculate potential miles earnings. This also gives you an idea whether you will hit the maximum spends on cards you apply.

For example, when I did this exercise, I discovered that our family spent:

- $500-600/month on groceries and household essentials

- $400-500/month on online shopping

- $350/month on dining and entertainment

- $150/month on petrol

This awareness helped me choose cards that offered bonus points in these specific categories, maximizing my miles earning potential.

Step 2: Choose the Right Cards for Your Spending

This is where the magic happens. Different credit cards offer different rewards rates for different spending categories. The goal is to match your spending patterns with cards that reward those categories most generously.

Here’s the approach:

- Start with one good general spending card: This should be your foundation – a card that allows you to earn miles on most of your purchases (typically 4 miles per dollar).

- Add category-specific cards as needed: Once you’re comfortable, consider adding cards that offer bonus miles in your top spending categories (often 3-4 miles per dollar or more).

- Take advantage of sign-up bonuses: These are often worth 10,000-30,000 miles just for meeting minimum spending requirements (which you’d hit anyway with normal expenses).

Important principle: Don’t get cards just for the sake of collecting them. Only get cards that align with your actual spending patterns and that you can manage responsibly.

For my family, I strategically use:

- One card for earning interest on our emergency fund, retail and online shopping

- One card for groceries and dining out

- One card for contactless payments – shopping in stores

- One card for online shopping

I’ll share specific card recommendations and comparisons in [Best Credit Cards for Miles in Singapore], but the key is matching cards to your spending, not the other way around

Step 3: Pay in Full, Every Month – No Exceptions

This is the most critical step. If you carry a balance and pay interest, you’ll lose money, not save it.

Here’s my system for ensuring I never carry a balance:

- Set up automatic full payment: Configure your cards to automatically pay the full statement balance from your bank account each month. This removes the risk of forgetting or being tempted to pay only the minimum.

- Pay off all other cards on the same day each month: As automatic full payments only work for cards in a bank you have a checking or savings account with, schedule one fixed day a month where you pay off the balance in full for these cards. This ensures that you never miss a payment.

- Only spend what you already have: Before making any purchase on a credit card, I ask myself: “Have I budgeted for it?” If not, I don’t buy it. I don’t use instalment plans for any kind of retail purchases.

- Check balances weekly: I quickly review my card balances every week to ensure spending is on track. This takes less than 5 minutes but prevents surprises.

- Use one card at a time (if needed): When starting out, some people find it easier to use just one rewards card until they’re comfortable with the system. There’s no rush to use multiple cards.

The golden rule: If you’re not confident you can pay in full every month, don’t use credit cards for rewards. The interest charges will quickly wipe out any miles you earn. This strategy only works for people who can treat credit cards like debit cards – spending only what they have.

In the next section, I’ll cover the eligibility requirements and red flags to watch out for when selecting cards.

Start Earning Miles – What you need

Before diving into credit card rewards, it’s important to make sure you’re eligible and set up for success. Here’s what you need to know.

Basic Eligibility Requirements

You’ll need to be at least 21 years old, a Singapore citizen/PR/EP holder, have good credit history, and meet minimum income requirements ($30,000 for basic cards, $50,000-$120,000 for premium cards).

Earn Miles with Credit Cards – Checklist

When evaluating which mile rewards cards to get, compare these factors:

- Miles earning rate: Aim to earn 4 miles per dollar for your main spending categories.

- Sign-up bonus: What’s the welcome bonus, and can you realistically meet the minimum spending requirement within the timeframe?

- Points pooling: Do points earned on different cards pool together? It is easier to redeem points that pool together.

- Annual fee: Is there an annual fee? If so, do the rewards justify it? Some cards waive the first-year fee. As long as you spend sufficiently and regularly on each card in the following years, you can apply for a fee waiver.

- Miles expiry: How soon do the miles expire? I recommend choosing cards with a 2-year validity from the time of earning. That together with Singapore Airline’s expiry of 2 years will allow you at least 3 – 4 years to accumulate the miles.

- Spending caps: Some cards cap bonus miles to maximum of $1000 – $2000 a month. Does this fit your budget?

Red Flags to Watch Out For

Not all credit cards are created equal. Here are warning signs that a card might not be right for you:

- High annual fees without proportional rewards: If a card charges $200+ annually with no possibility of waiver (look out for the line .. “with payment of annual fee”) but doesn’t offer significantly better rewards than free cards, it may not be worth it.

- Complicated redemption rules with no clear indication of expiry date: Some cards make it difficult to plan your redemption.

- Low conversion rates: If the card only offers 1-2 miles per dollar on general spending with no category bonuses, you can likely do better elsewhere.

- Short expiry periods: Cards where points expire within 1 year can be problematic if you’re accumulating miles for a big trip.

- Unrealistic spending requirements: Some premium cards require very high monthly spending to justify their benefits. If you can’t naturally hit these thresholds, look elsewhere.

My recommendation: Start simple. Get one solid rewards card that matches your primary spending category, use it for 2-3 months, and make sure you’re comfortable paying it off in full each month. Once you’ve built confidence with the system, you can add more cards strategically.

In the next section, I’ll show you exactly how I earned over 260,000 miles in 3 years using this system – with real numbers and specific examples.

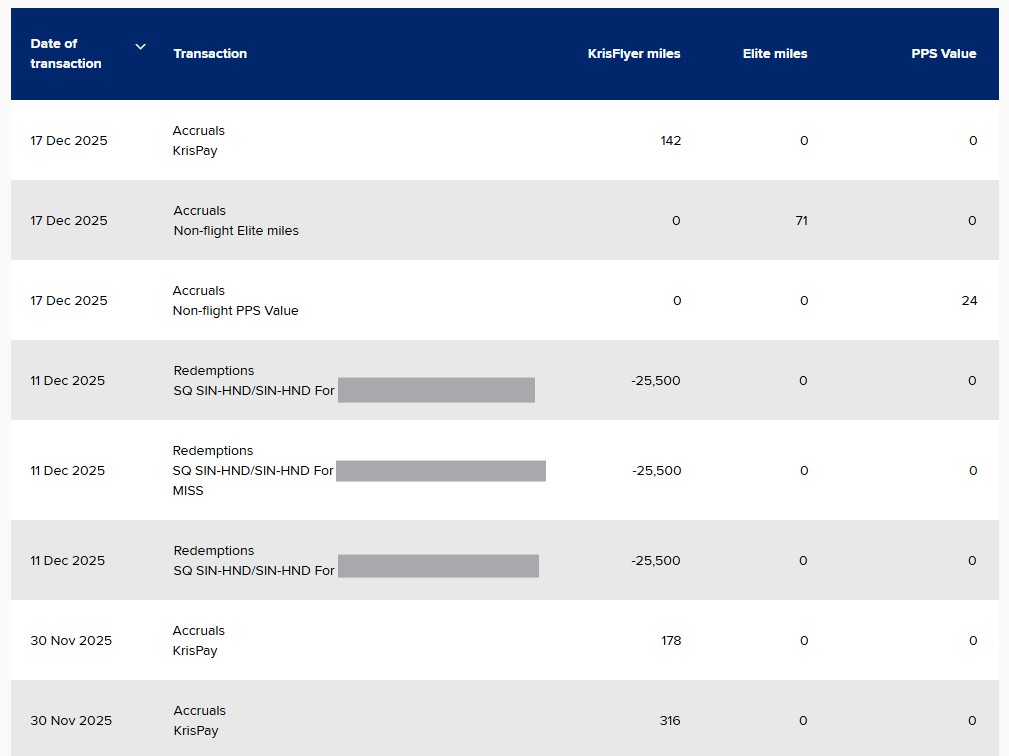

How I Earned 260,000 Miles in 3 Years

Let me walk you through exactly how my family earned over 260,000 miles in 3 years (2022 – 2025) without changing our spending habits or buying anything we didn’t need.

| Source | Singapore Airlines KrisFlyer | Cathay Pacific Asia Miles | Total |

|---|---|---|---|

| Credit card purchases | 108,800 | 108,000 | 216,800 |

| KrisPay | 20,000 | – | 20,000 |

| Credit card sign-up bonuses | 26,600 | – | 26,600 |

| Miles from flights | 6,800 | – | 6,800 |

| Total Miles Earned | 162,200 | 108,000 | 270,200 |

Breakdown of My Miles Earned

- UOB Uni$ conversion: 70,000 (your biggest)

- AMEX transfers: ~35,400 (due to sign on bonus)

- Citibank Rewards Card: 20,000

- KrisPay spending: ~20000

- OCBC: 10,000

So, let me further breakdown the points from credit card purchases for Krisflyer. I was able to obtain this data from Singapore Airlines’ detailed miles statement.

1. Shopping (Everyday Expenses)

These miles came from our regular household spending that we would have done anyway:

- Groceries and household essentials ($500-600/month)

- Online shopping for clothes, toys, and household items ($400-500/month)

- Dining out and entertainment ($350/month)

- Petrol and transportation ($150/month)

- Bills and utilities where possible

- Occasional larger purchases (furniture, appliances, electronics)

These purchases can be stacked by paying through the Kris+ app.

Read my review of Kris+ app as an important way to earn even more miles with the same purchases.

2. Credit Card Sign-Up Bonuses

Sign-up bonuses contributed 26600 miles to our total. Here’s how:

- Applied for cards strategically when there were good welcome offers (typically 10,000-30,000 miles per card)

- Met minimum spending requirements using our regular expenses (not extra purchases)

- Timed applications to coincide with periods of higher spending (e.g., before holidays or planned purchases)

The key was only getting cards that aligned with our spending patterns and that offered bonuses we could realistically earn through normal expenses.

Important note: These numbers represent miles earned from our family’s spending patterns. Your results will vary based on your own spending levels and card choices. The principle remains the same: maximize miles from spending you’re already doing.

Selecting the Right Airline Programme

After you have earned your credit card points, which airline miles programme should you use to redeem flights? Since we fly out of Singapore, I find that it is the easiest to manage everything in our national carrier, Singapore Airlines. It would allow me to use up smaller quantities as well to redeem gifts, should my points expire.

Their redemption is easy to use as simple and straightforward to search for flights. You can read about my redemption guide here.

At the start, I made the mistake of transferring miles to Asia Miles and learnt the hard way that I found their outbound flights from Singapore didn’t meet our needs. For example, they didn’t have direct flights from Singapore to Japan.

Ready to choose the right cards for your family?

Check out [Best Credit Cards for Miles in Singapore] for my detailed recommendations and comparison.