Everyone should have an emergency fund to tap on in the event of unplanned and unexpected situations. It is the first step towards financial security and stability. In this article, I will talk about how to calculate your emergency fund. I also share my free resource – customisable Google Sheets budget and emergency fund calculator

For parents, having children means our essential needs may increase or decrease over time. We want to be prepared for any kind of emergency. Financial experts recommend anywhere between 3 to 6 months of living expenses in your account. If you are building a fund, you can read more about building an emergency fund in a comprehensive guide I wrote specifically for parents.

How do I calculate my emergency fund?

Steps:

- Write down all your budget categories. Budget categories will capture everything you spend money on.

- Track how much you spend in each budget category. Make an estimate if you don’t know.

- Determine which is an essential expense. Essential expenses are things you need to carry on day-to-day living (work, school, housing, healthcare, food, utilities)

- Add up your essential expenses.

- Multiply it by the number of months you want to save for.

- Find out how much you will need to save. Dividing your emergency fund by the amount you contribute each month.

- Track your expenses.

- Review expenses and budget to optimise your spending and maximise your savings.

- Journal and reflect to stay on track.

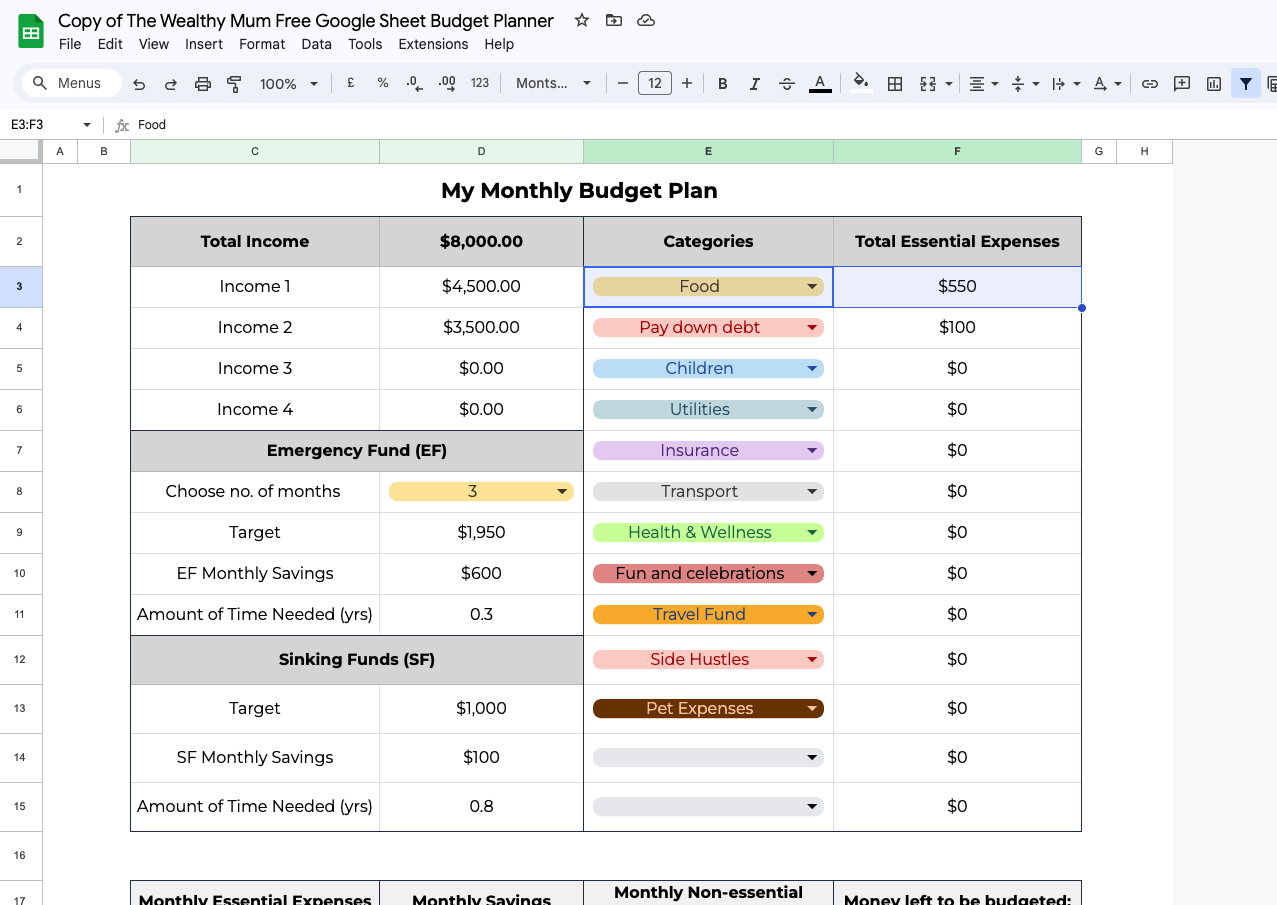

If steps 1 – 9 feel overwhelming, I have designed an Emergency Fund Challenge that comes with free resources that guide you to calculate your emergency fund. One of the resources is a budget planner with an inbuilt emergency fund calculator. With my calculator, it will take you only 10 minutes to complete step 1 – 6.

Sign up for the Emergency Fund Challenge here.

As everyone’s situation is unique, your emergency fund journey will not be the same as others. Instead of falling into the trap of comparison, make personal progress. I am here to help you with that.

Should I have a 3 or 6 month emergency fund? How much should I have in my emergency fund?

3 months: A good start and recommended for parents with stable income and fewer dependents or grown-up children capable of earning their own income.

6 months: Recommended for most and definitely necessary for single-income households, freelancers, those in high risk industries or families with higher medical needs.

9 – 12 months: A very safe buffer and prudent target. This gives a great peace of mind and security in the event of income loss or more impactful emergencies such as loss of home or serious medical injury.

When you calculate your emergency fund, you know exactly how much you need gives you a concrete goal to work towards.

No matter what your end goal is, start with any amount you can afford – even $100 a month will make a difference. Then, build your emergency fund savings over time to create at least 3 months of reserves for essential expenses.

How quickly should I build my emergency fund?

It will take 15 months to save up 6 months of expenses if you save 20% of your income by following the 50 (needs) – 30 (wants) – 20 (savings) rule of budgeting.

Our budget is intricately linked to our savings. So, the less you spend the more you save. And the more you save the faster you will reach your goals.

As a parent, I keep a close eye on my different budget categories and I always look for opportunities to spend less.

I do so with the YNAB budgeting app but if you’re looking for a free platform for a start, I created an Google Sheets budget planner with an inbuilt emergency fund calculator for my followers.

You can receive it as part of my Emergency Fund Challenge. Do check it out if you don’t know how much you should spend and need to save each month to reach your emergency fund goals.

Can I start with a small emergency fund?

If you are starting from scratch, prioritise saving a small amount such as $1000. Think of it as a seed fund for your emergencies. Reduce non-essential expenses as much as you can to increase monthly savings.

No matter how tempting it is, avoid using your emergency fund for non-essential large expenses like a holiday. Keeping your savings in a separate savings account so that it is not easily used for payments.

If you withdraw money to pay for an emergency expense, top it up as soon as you can.

I recommend tracking expenses and reviewing the family’s essentials and non-essentials every quarter to find as many opportunities to increase savings as possible. I share many budget tips and saving strategies without feeling restricted or deprived so be sure to follow me on my socials and subscribe to my newsletter.

Saving on a low income

I completely understand that sometimes life deals us a hard hand and despite our best efforts, there is no way we can save 20% of our income after providing bare essentials for the family and paying down high interest debt. In such a situation, set a whole number goal that is achievable within a year.

For example, if you can only save $50 a month. Aim to accumulate $600 by the end of the year. No matter what the amount, remember that any savings provides a buffer and protection against debt and financial stress.

Review your spending and choices monthly and stay open to ideas or prompts that come to you to improve your financial situation.

Paying off debt vs saving

If you are caught between credit card debt and saving, credit debt should come first because it is a financial hardship you have to overcome and deal with.

It is a good practice to keep a small emergency fund. The aim of the small emergency fund is to prevent adding to debt during unexpected expenses.

Only you can decide how much is a comfortable amount for you. If in doubt, I would recommend starting with at least $500. Review monthly to assess if you need to increase your emergency savings to prevent incurring more debt.

As it is a precarious situation, try to resolve it as soon as possible.

If you are unable to meet your credit card payments at any one point in time, seek credit counselling immediately. I would call the bank and seek their advice on the steps you can take. Ask if you can reduce the interest or work out a consolidated debt payment plan. These are the right steps to take towards financial security and stability.

I would not recommend using your emergency fund to pay off secured loans (home, car loan, mortgage) as that can leave you vulnerable to financial stress should the unexpected occur.

Similarly, for unsecured loans (payday loans, personal loans, student loans) avoid using your emergency fund to pay for them. Repay them systematically and as soon as you can. If it has a fixed repayment term, adhere to it to avoid unnecessary fees.

My personal experience and thoughts

I had a very rigid view of my emergency fund. I calculated my emergency fund to be about $100, 000 for 12 months and wanted to keep it at that amount no matter what. Drawing from it to pay for unexpected expenses made me feel lousy and anxious.

My experience has taught me that life is unpredictable and now I think of my emergency fund as a strong stable oak tree. It is dynamic and provides stability and security. I withdrew money to pay for a new set of air-conditioning for the house when it broke down unexpectedly in December.

Having the money sitting there and ready for use was the best feeling in the world. My husband and I could make quick decisions and rectify the situation as fast as possible. We then made plans to top it up to our ideal amount of 6 months.

I would go back to my budget sheet. In such a case, I would duplicate a copy of the budget tab in my Google Sheet budget planner and carry out process 1 – 9 stated above and find opportunities to spend less in the next few months to increase my contribution to my fund temporarily.

As the children grow, I do exactly what I preach – review our expense and adjust our emergency fund accordingly, topping it up if necessary.

Get the free Google Sheet Budget Planner and Emergency Fund Calculator

Your financial security starts with one step. All the free resources to calculate your emergency fund and save consistently to hit your goal are available through the Emergency Fund Challenge where I walk you through each step of the way.

You can go at your own pace and start wherever you are.

So whether you’re just starting to save up or reassessing your current savings plan, my tools will definitely help to break down your goals into achievable steps.

Don’t wait for the unexpected.

Have questions about building your emergency fund? Reach out to me on Instagram at @the.wealthymum. Let’s work together to create a financial safety net that gives you peace of mind.