An emergency fund is 6 – 12 months of cash reserve set aside to pay for large, unexpected expenses or financial emergencies. This can include

- Unemployment

- Unforeseen medical expenses

- Major car breakdown

- Loss of income

An emergency fund is the first step in providing financial security for our families. Our children depend on us to provide for their basic needs so nothing beats financial stability during an unforeseen financial emergency.

Knowing that our family can be well taken care of provides us with a peace of mind. When we know there is money available, we can focus our energy on solving the problem at hand.

Studies have shown that rising costs are making it challenging for consumers to save so it is critical to start one immediately on your first job and build it as your family grows.

Why Families Need One

Whatever the makeup of your family is, having liquid savings provides a financial cushion for common family emergencies.

As a family grows, the chances of unexpected situations happening increase. Families with younger children tend to have higher needs as well.

Having emergency savings to handle these surprise situations will reduce our stress and mental load

- Emergency travel: Last minute transportation and accommodation often cost more

- Job loss or income reduction: Financial strain due to sudden unemployment or reduce in work hours or commissions paid

- Legal fees: Large legal costs for proceedings such as divorce, lawsuits or disputes

- Childcare costs: Gaps in care, changes in childcare arrangement or last minute babysitting needs can increase expenses

- Car breakdowns: mechanical failures in major parts such as tyres, gear box, air conditioning can result in urgent repair costs

- Home repairs: Plumbing issues, water leaks, structural damage often require immediate and costly repairs

- Major appliance failures: Breakdown of essential appliances like the fridge and washing machine often demand immediate replacement

- Natural disasters such as flood, hurricanes: often result in costly damages, loss of property and even injury

- Education and mental health needs: Professional support such as counselling or therapy may be required

- Pet emergencies: Health issues with pets can incur huge medical costs especially without pet insurance

How Much Should Families Save?

The general rule of thumb is to have 3-6 months of household expenses. Hence, a bigger fund is needed for larger families. Some families put aside up to 12 months of emergency funds.

The “right” emergency fund is different for everyone. It depends on your lifestyle, family size, children’s needs and home-related costs.

Calculate your emergency fund

To calculate your emergency fund, add up your basic expenses for the family each month. This ensures that your savings are sufficient to cover essential needs during a financial setback. This prevents you from having to dip into your credit cards or take out loans.

Consider what the family needs avoids the risk of not having enough when you need it the most. Each family’s needs would vary and you would know your family best.

You should include these categories:

- Housing (mortgage/rent)

- Groceries

- Utilities (water, electricity bills, telco, internet)

- Childcare / schooling costs (daycare, school fees babysitting fees, basic supplies)

- Pocket money and allowances (for children and aged parents if needed)

- Transportation costs (auto loan, public transportation)

- Medical needs (medication, doctor visits)

- Insurance

Add up how much you would need in each category and multiply it by 3, 6 or 12 months to derive your ideal emergency fund.

In the event of a total loss of income, it helps to know what a barebones, reduced lifestyle budget would look like for your family. Do this by leaving out wants and including only what is needed to keep the family going.

A reduced lifestyle also allows funds to be stretched over a longer period of time to cope with the new financial situation. It may not be ideal but it will support the family in the longer term during crises such as disability, health issues or unemployment until the situation can be remedied.

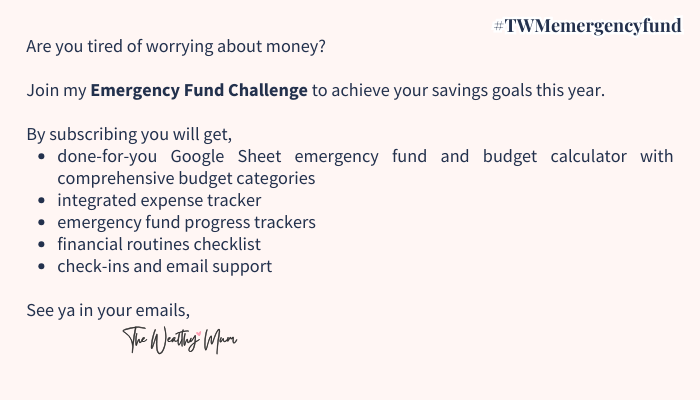

It can be overwhelming if you don’t know where to start. Consider joining The Wealthy Mum Emergency Fund Challenge where you will get free, easy-to-use but practical done-for-you resources to get you started quickly.

👆JOIN THE WEALTHY MUM EMERGENCY FUND CHALLENGE

Where to Stash Your Emergency Fund

Choose a high-yield savings or current account with a competitive interest rate to store your savings. Because you will want immediate access to your funds especially when you need it on short notice. It is extremely low risk with reputable banks.

Interests earned from savings will compound and help you to grow your emergency fund.

Some accounts may need you to fulfil spending or payment criteria to earn bonus interest. So stick with one that is easy for you to achieve.

I am in Singapore and I use the OCBC 360 account to store our emergency fund. To fulfill that, I spend $500 on a credit card, credit my salary and top up at least $500 each month to earn 3.8% pa.

There are other low risk (but not no risk) cash management investment products. One reason why you might consider alternatives to a savings account is if your emergency fund has grown to a point where it busts the upper limit of your savings account and would no longer enjoy competitive interest rates.

Planning Your Emergency Fund

Once you have decided on how large you want your emergency fund to be, break it down into manageable targets and milestones.

Start with $500. Then, grow it surely but steadily to your final goal.

The time it takes to save up depends on your monthly cash flow. For example, if your family spends 50% and saves 50% of your take-home income, you can build a 3-month emergency fund in just 3 months.

However, if your family spends 80% of take-home income, it will take a whole year to save a 3-month fund.

Every family’s situation is different. Whatever your situation is, know that committing to saving up an emergency fund is a step in the right direction.

You are practising good financial habits and setting a wonderful example for your children even if it takes you longer.

Setting Realistic Goals for the Whole Family

Get the family on board: Share your plans, especially with your children and encourage them to share their ideas. Organise a family meeting and explain how an emergency fund is a necessary safety net for everyone’s future. Use simpler words for younger kids.

Define clear goals: Get specific about the number and duration. For example, “save $1000 for emergencies by Dec” or “Reduce monthly dining out expenses by 20%”.

Make it manageable: Give the family time to adjust to changes. Scaling goals is a great way to get started. For example, save $100 a month for 3 months and then $300 for 9 months.

Involve the children: Children pick up frugal consumption really quickly. Assign them tasks like switching off lights to save on electricity or helping to pack snacks. Older kids can be tasked with finding deals and promotions.

Celebrate milestones: Reward yourselves with a treat when you hit a goal. Celebrations don’t need to cost money if you focus on quality time together. Plan a home movie night or try a new dinner recipe together. Visit a new park or spend a day at the beach.

Stay flexible: Life is unpredictable. If circumstances change and you incur unexpected expenses or make mistakes, adjust your goals without guilt. Remember that there are no problems, only projects.

Be gentle: If you have an unwilling partner, adopt the mindset of a sales person and pitch the idea of saving for an emergency fund by focusing on what value the emergency fund would bring most to your partner.

How to save up for an emergency fund quickly

Create a bare-bones budget: Focus only on absolute essentials such as mortgage, food, utilities. Temporarily reduce or eliminate spending on luxuries like coffee runs, snacks or entertainment.

Slash all non-essential spending: Cut down on expensive frappucinos, dining out, holidays, gifts, branded clothes, bags and makeup. Take public transport. Cancel subscriptions.

Find deals and cheaper brands: Buy things only at a discount and use house brands to save money on daily necessities like formula, diapers, coffee, and groceries. Read my article on how to save money on groceries.

Shop at thrift stores or use secondhand: Buy clothes, shoes, appliances and furniture for a fraction of retail prices. Embrace hand me downs especially kids furniture, clothes and toys which they outgrow quickly.

Automate your savings: Set up automatic transfer to your account every time you receive income. Start small, even $50 a month will add up.

Earn extra income: Take on side gigs such as freelance work, tutoring or babysitting. Sell unused items like toys, kids furniture, car seats, baby carriers.

Increase your income: Actively seek out new employment opportunities.

Start a side hustle: Invest some money in yourself and commit to a side hustle to earn extra money. A side hustle that doesn’t require a lot of money to start is affiliate marketing.

Important note:

It can be difficult to deny the family all non-essential spending for a long period of time.

Over-restricting can lead to resentment and can cause negative feelings towards a budget and savings. This emotional strain can trigger revenge spending and install limiting beliefs about money.

To prevent this, I would like to introduce my practical balanced approach to spending: Splurge Some Save Some.

This approach of mine encourages us to spend on experiences that add value to our lives, aligned to our family’s values, interests and likes and save on transient things which won’t make a difference.

Emergency Fund Challenges Families Face and How to Overcome Them

A family’s financial success starts with the mindset of the parents. Mindset-related challenges and the unpredictability of life means that progress of building the emergency fund won’t be linear. Learn to be ok with that.

Unplanned expenses: Expenses arise out of new family needs (e.g. tuition for Math or health support for an aging family member) can impact the budget.

Impact on saving: Slows down savings efforts as funds are diverted to immediate needs.

Solution: Adjust budget to accommodate the new need. Prioritise saving and reduce spending in non-essential areas temporarily. Consider strategies to reduce spending in other areas or increase income. Seek community help if needed.

Living with a scarcity mindset: Growing up in financial hardship may cause parents to view money-saving as a sacrifice rather than a strategy for financial security. “No matter what, it’ll never be enough.”

Impact on saving: Avoidance to saving efforts or overspending out of fear of missing out.

Solution: Shift to an abundance mindset by focusing on the possibilities that savings can bring. Focus on the goodness of money. Plan for enjoyable activities for the family by saving up for it to reframe mindset.

Fear of depriving the family: Think that savings means saying “no” to children or family members frequently.

Impact on saving: Overspending on wants (e.g. trips, toys, outings, snacks, parties) leaves little room for saving.

Solution: Reframe saving, prudence and frugality as a family value. Teach children that saving for goals empowers the family.

Guilt around money management: Parents may feel guilty about their past financial mistakes or believe they should be able to “do it all.”

Impact on saving: Guilt leads to procrastination, cycles of overspending followed by regret. Guilt can paralyze our ability to plan, act and adjust on savings.

Solution: Show forgiveness and accept past mistakes as lessons. Start fresh by setting small, achievable goals and celebrating progress.

Different money mindsets of partners:

The Saver vs The Spender

The Saver values saving and finds comfort in financial security. The Spender believes in enjoying money in the present, prioritizing wants over long-term goals.

Impact on saving: Conflicts arise when one feels deprived and the other feels insecure. Savings goals can be sidelined if a compromise isn’t reached.

Solution: Agree on a budget and allocate a portion of income for savings and discretionary spending

When to Use Your Emergency Fund for Family Emergencies

Differentiate between a true emergency, non-recurring infrequent large expenses and non-essential spending.

True emergencies:

A true emergency is an unexpected situation that requires immediate attention and financial resources to prevent significant harm or disruption to your family’s well-being. These situations are typically urgent, unavoidable and outside of your normal budget.

Examples:

- sudden illness requiring immediate medical care

- medication or treatments not covered by insurance (e.g. shingles)

- Unexpected unemployment

- car breakdowns

- Leaking toilets

- Temporary housing due to domestic issues

When these occur, it is time to use the emergency fund.

Using an emergency fund can evoke a huge range of emotions from relief, frustration to uncertainty. From “I am glad I had this fund” to “Why does this always happen to me? What if something else comes up? How long will it take to save up again?”

Acknowledge your feelings as it is normal to feel a mix of emotions when you have to dip into a fund you took years to build.

Focus on the positives and remind yourself that the fund has served its purpose, protecting you from financial stress or debt.

Continue to set realistic goals and replenish the fund so you feel in control again.

Seek support if needed as dealing with emotional stress around finances can be overwhelming. A friend or trusted financial buddy can provide a listening ear, perspective and practical advice. I am always an email or DM away.

Non-recurring infrequent large expenses:

Non-recurring infrequent large expenses are significant costs that don’t happen all the time but are not necessarily emergencies.

Usually these are predictable and can be planned and budgeted for in advance. However when it is not budgeted for, these expenses can strain your budget.

Examples:

- Major home repairs

- Replacement of furniture

- Furniture for growing children or aging parents

- Appliance replacement

- Vehicle maintenance, road tax and insurance

- Educational costs (tuition, enrichment)

- Life milestones (anniversaries, weddings, birthday celebrations)

- Large medical bills (root canal, wisdom tooth removal, braces)

- Travel or vacations

- Seasonal costs (Chinese New Year, Christmas, Hari Raya)

The best way to manage is to plan ahead. Identify potential large expenses for the next 1-3 years and create sinking funds to save gradually for these costs.

Adapting Your Fund as Your Family Grows

Adjusting your emergency fund ensures that it grows with your family.

Consider increasing emergency funds for additional children, aging parents, new expenses or when there are changes in your household income or employment situation.

As our children grow older, their dependence on us decreases gradually and emergency funds can also be adjusted to reflect that.

A well-prepared emergency fund is a gift of security for your loved ones, allowing you to focus on your well-being and the family’s needs during challenging times.